New to real estate investing? Our House Flipping 101 Home Renovation Blog provides expert tips and advice to help you get started and achieve financial success. Mahalo for joining us at Eco-Luxe Living: Hawai’i!

Beginner’s Guide to House Flipping

Flipping Houses 101: A Calculated Risk for Real Estate Entrepreneurs

Flipping houses has become a lucrative and exciting venture for real estate investors seeking to capitalize on property value appreciation. While it offers the allure of substantial financial gains and the promise of revitalizing neighborhoods, it’s not a journey for the faint of hearts.

Unveiling the Realities of Real Estate Flipping

Flipping houses involves purchasing a property in disrepair or undervalued, renovating it, and then selling it for a profit (sounds so easy, right?!). The core idea is to transform a neglected or outdated property into an attractive, modern, and marketable one. However, it’s a complex endeavor that demands a blend of financial acumen, renovation expertise, and strategic thinking.

In this week’s Home Renovation Blog, we’ll delve into the intricacies of house flipping, examining the following:

- The Basics of House Flipping 101: Understanding the process, from property acquisition to renovation and sale.

- The Risks Involved in House Flipping: Exploring potential challenges, such as unexpected costs, market fluctuations, and regulatory hurdles.

- The Courage Required to Flip Houses: Discussing the personal qualities needed to succeed in this competitive field.

- Potential Downsides: Examining the drawbacks of house flipping, including the time commitment and emotional toll.

- The Rewards: Highlighting the substantial financial benefits and the positive impact on communities.

By the end of this blog post, you’ll have a clearer understanding of whether house flipping is the right investment strategy for you.

Introduction to House Flipping 101

Are you dreaming of financial freedom and a life of adventure? House flipping could be your ticket to achieving both. This comprehensive guide, House Flipping 101, will equip you with some of the knowledge and tools we’ve learned along the way – tools you will need to embark on this exciting journey.

In this blog, we’ll cover the essential aspects of house flipping, including:

- Finding the Right Property: Discover the key factors to consider when searching for a potential flip, from location and condition to potential return on investment.

- Financing Your Flip: Explore different financing options, such as traditional loans, hard money loans, and private lending, and understand the pros and cons of each.

- Renovation Strategies: Learn about effective renovation techniques and strategies to maximize your investment, while ensuring a high-quality finished product.

- Marketing and Selling Your Flip: Master the art of marketing your flipped property to attract potential buyers and negotiate the best possible deal.

- Avoiding Common Pitfalls: Discover the most common mistakes made by new house flippers and learn how to avoid them to ensure your success.

Whether you’re a seasoned investor or just starting out, House Flipping 101 will provide you with valuable insights and practical advice to help you achieve your real estate goals.

House Flipping 101.1. Finding the Right Property: The Foundation of Successful House Flipping

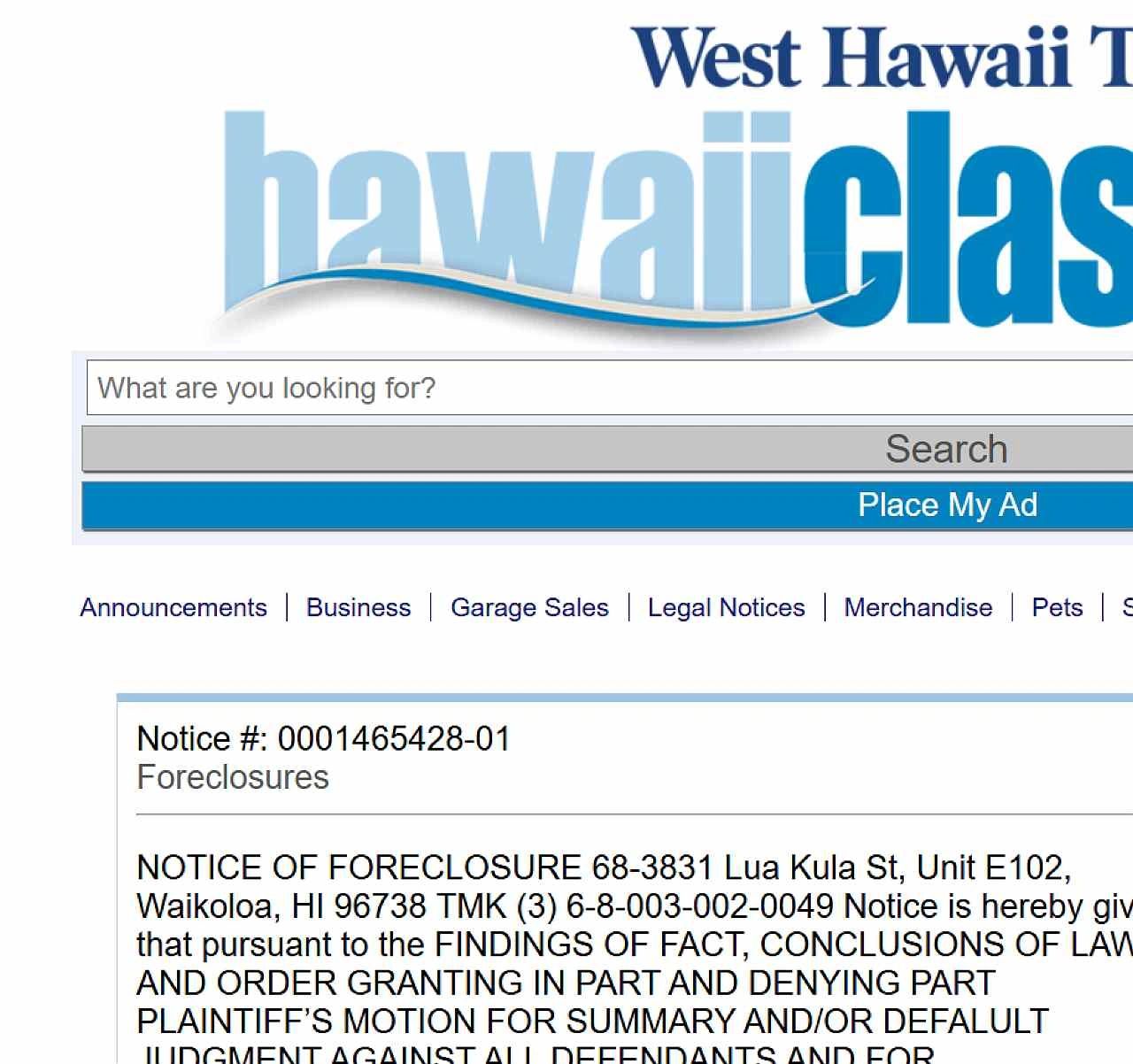

1. Finding Foreclosure Sales: A Guide to County Auctions and Other Resources

When searching for foreclosure properties, county foreclosure auctions are often a great place to start. These auctions allow you to purchase properties by way of a Commissioner’s Deed, potentially at a significant discount.

County Foreclosure Auctions:

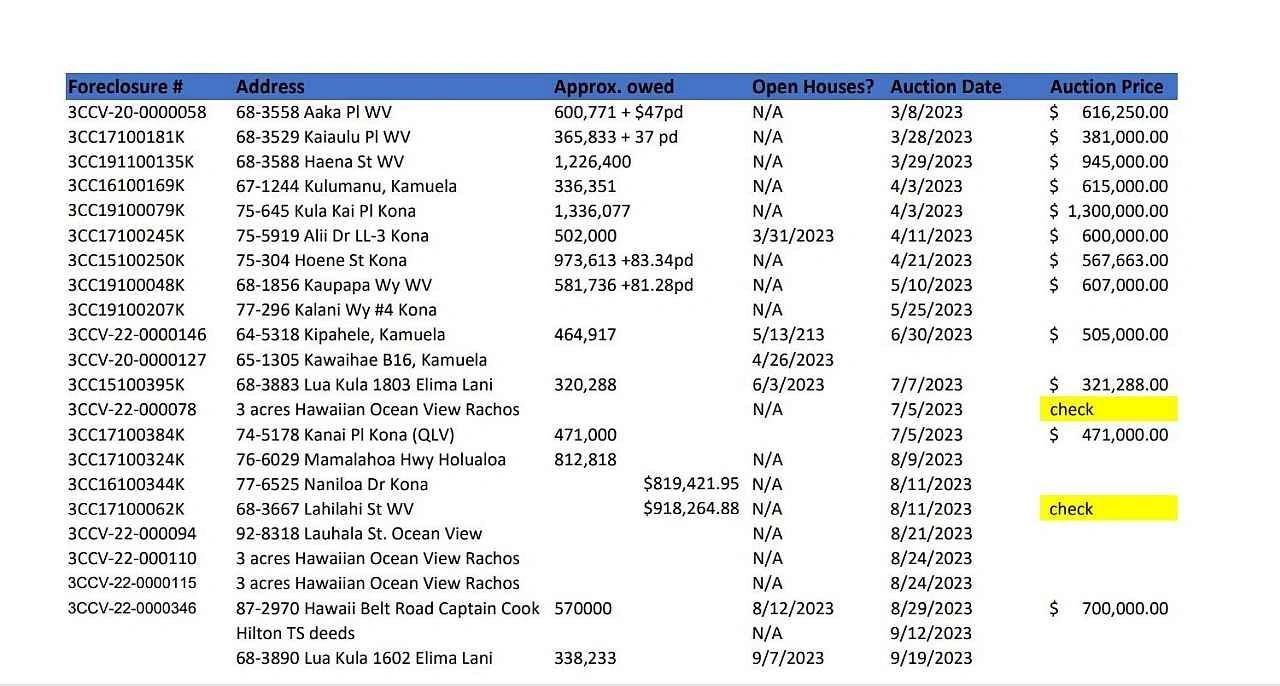

- Research: Do a Google search for the county foreclosure auction details for the county you live in, as each county has its own rules for holding judicial foreclosure proceedings. In Hawai’i County, for example, the foreclosure listings for the county are published in the local newspaper by the court-appointed commissioner (lawyer). Each ad runs for 5-7 days (online and in print), and once the ad expires, unless you have written down the case number, you have little chance of finding the auction information. The court does not keep a list of upcoming auctions on its website, even though the auctions are held at the flagpole outside the courthouse in Kona. The limited information that is available from the county is generally incorrect, so it’s very important to keep detailed spreadsheets.

- Attend Auctions: Visit auctions before bidding! This is the best way to familiarize yourself with the auction rules and bidding procedures.

- Cash or Certified Check: Be prepared to pay in cash or with a certified check if you win the bid. Generally speaking, you need to have 10% of the maximum bid you are willing to make. The court-appointed commissioner will collect the 10% deposit, if you are the high bidder, and open a bank escrow account to deposit the funds until the transaction can be moved to a title company to handle the closing.

Other Resources:

- Online Foreclosure Listings: Websites like RealtyTrac, Auction.com, and Zillow offer extensive listings of foreclosure properties.

- Real Estate Agents: Many real estate agents specialize in foreclosure properties and can help you find suitable listings.

- Newspaper Listings: As mentioned previously, local newspapers often publish foreclosure notices.

- Public Records: Check public records to identify properties that are facing foreclosure proceedings.

Tips for Finding Foreclosure Deals:

- Act Quickly: Foreclosure sales can move quickly, so be prepared to act fast when you find a property that interests you.

- Do Your Research: Thoroughly research the property’s condition, history, and neighborhood to make an informed decision.

- Consider Renovations: Be prepared to invest in renovations to bring the property up to market value.

- Negotiate: If you’re dealing with a pre-foreclosure sale, you may have an opportunity to negotiate with the homeowner.

By exploring these resources and following these tips, you can increase your chances of finding great foreclosure deals and potentially achieving a significant return on investment.

2. Location of the Flip Property:

Selecting the perfect property is the cornerstone of a profitable house flip. A well-chosen property can significantly increase your chances of success, while a poor choice can lead to significant financial losses. Here are the key factors to consider when searching for a potential flip:

- Neighborhood: Research the neighborhood’s reputation, amenities, and proximity to schools, shopping centers, and transportation. And be sure to check out the neighbors – in a friendly way, of course!

Personal story: Our first flip was located in a great family neighborhood just five minutes to downtown Kailua-Kona, Hawai’i and the world-class beaches of the Kona Coast. Even though the neighborhood was in a great location, the property itself was next to a hoarder who played loud music at all hours. It took us eight months to sell after the renovation was done, and we lost an all-cash offer due to the neighbor situation. Eventually, we found the right buyers for this property, and they loved the house (and their new neighbor!). There’s a buyer for every house, as they say, but if you want to sell a property quickly, think twice about noisy and messy neighbors.

- Property Values: Analyze recent property sales in the area to assess market trends and potential for appreciation.

- Resale Potential: Consider the demographics of the neighborhood and the demand for similar properties.

3. Property Condition (if the flip property is available for inspections):

- Structural Integrity: Inspect the foundation, roof, and overall structural soundness to avoid costly repairs.

- Cosmetic Issues: Assess the property’s cosmetic condition, such as paint, flooring, and fixtures, to determine the extent of renovations needed.

- Potential for Value Add: Identify opportunities to increase the property’s value through renovations, such as updating the kitchen or bathrooms.

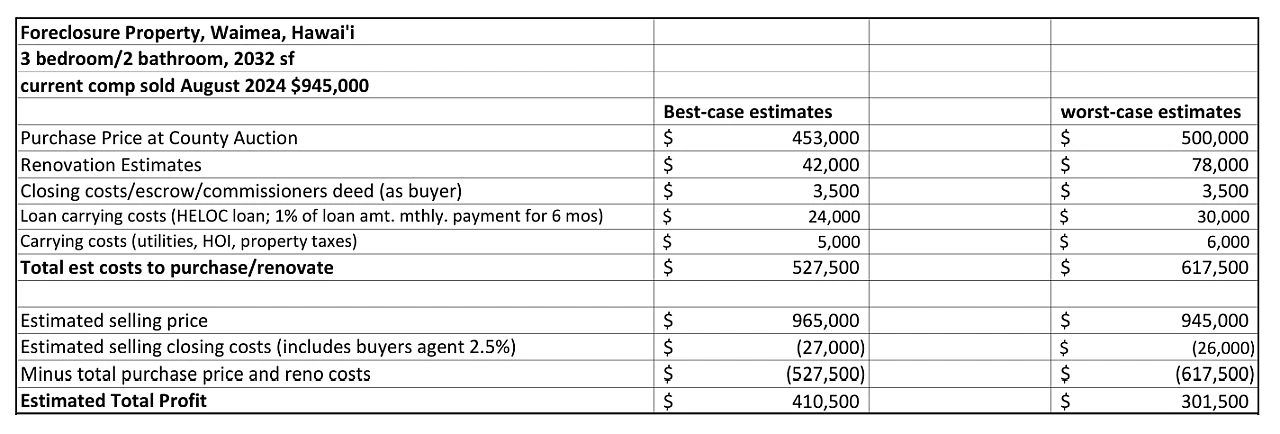

4. Return on Investment (ROI):

- Purchase Price: Negotiate a favorable purchase price to maximize your potential profit, if possible. At auction, have a limit price that you will not go above.

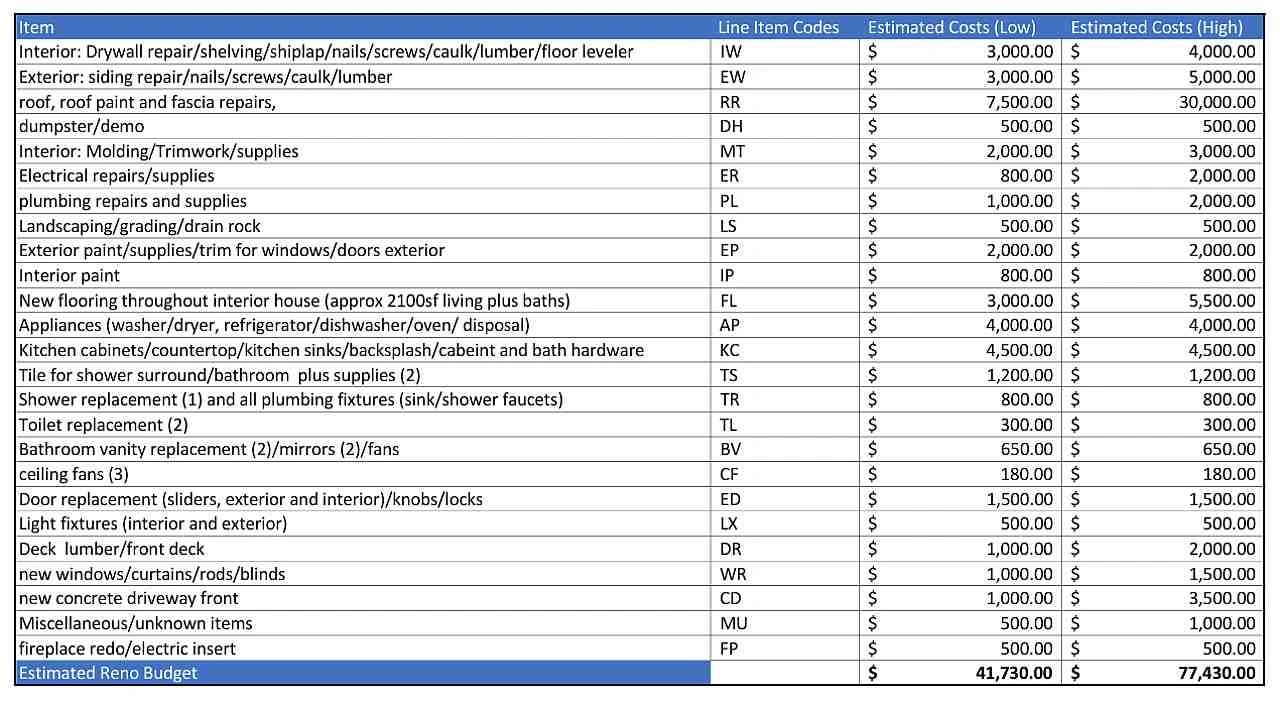

- Renovation Costs: Estimate the cost of necessary repairs and renovations based on quotes from contractors.

- Estimated Sale Price: Research comparable properties in the area to determine a realistic selling price.

- Profit Margin: Calculate your expected profit by subtracting the purchase price and renovation costs from the estimated sale price.

5. Additional Considerations:

- Zoning Restrictions: Ensure the property complies with zoning regulations and allows for the intended use.

- Environmental Issues: Conduct due diligence to identify any potential environmental hazards, such as mold or asbestos.

- Time Constraints: Factor in the time required for renovations and the selling process when evaluating potential flips.

By carefully considering these factors, you can increase your chances of finding a profitable house-flipping opportunity that aligns with your investment goals and risk tolerance.

House Flipping 101.2. Financing Your Flip: Navigating Different Loan Options

Securing the right financing is crucial for a successful house flip. There are several options available, each with its own advantages and disadvantages. Here’s a breakdown of the most common financing methods:

1. Traditional Loans:

- Pros:

- Lower interest rates compared to other options.

- Longer repayment terms.

- Often require less upfront capital.

2. Hard Money Loans:

The average hard-money loan in March 2024 costs 2 points per loan (each point is 1% of the loan amount in cash paid to the lender at closing as a fee for the loan), and interest-only payments average around 11%.

For example, if you were to get a $400,000 fix-and-flip hard money loan from a lender with these terms, you would pay $8,000 plus standard closing costs to get the loan. Your monthly payment would be interest-only of $3,667.

For a thorough analysis of hard-money loans, check out this article in U.S. News and World Report.

- Pros:

- Faster approval process.

- Flexible terms, often with interest-only payments during construction.

- Can be used for properties that may not qualify for traditional financing, often without requiring appraisals.

- Cons:

- Higher interest rates.

- Shorter repayment terms.

- Often require a higher down payment and charge points to secure the loan.

3. Private Lending:

- Pros:

- Can offer flexible terms and competitive rates.

- Often requires less documentation than traditional loans.

- Can be a good option for properties in distressed areas.

- Cons:

- May be harder to find a private lender.

- Interest rates can vary widely.

- May require personal guarantees.

Choosing the Right Financing:

When selecting a financing option, consider the following factors:

- Your Credit Score: A higher credit score may qualify you for better rates and terms.

- Down Payment: The amount of money you can put down will affect your financing options and interest rates.

- Renovation Timeline: If you need quick funding for a short-term flip, hard money loans or private lending may be more suitable.

- Risk Tolerance: Traditional loans generally offer lower interest rates but may be more difficult to obtain.

By carefully evaluating your options and understanding the pros and cons of each financing method, you can choose the best approach to fund your house-flipping venture.

House Flipping 101.3. Renovation Strategies: Maximizing Your Real Estate Investment

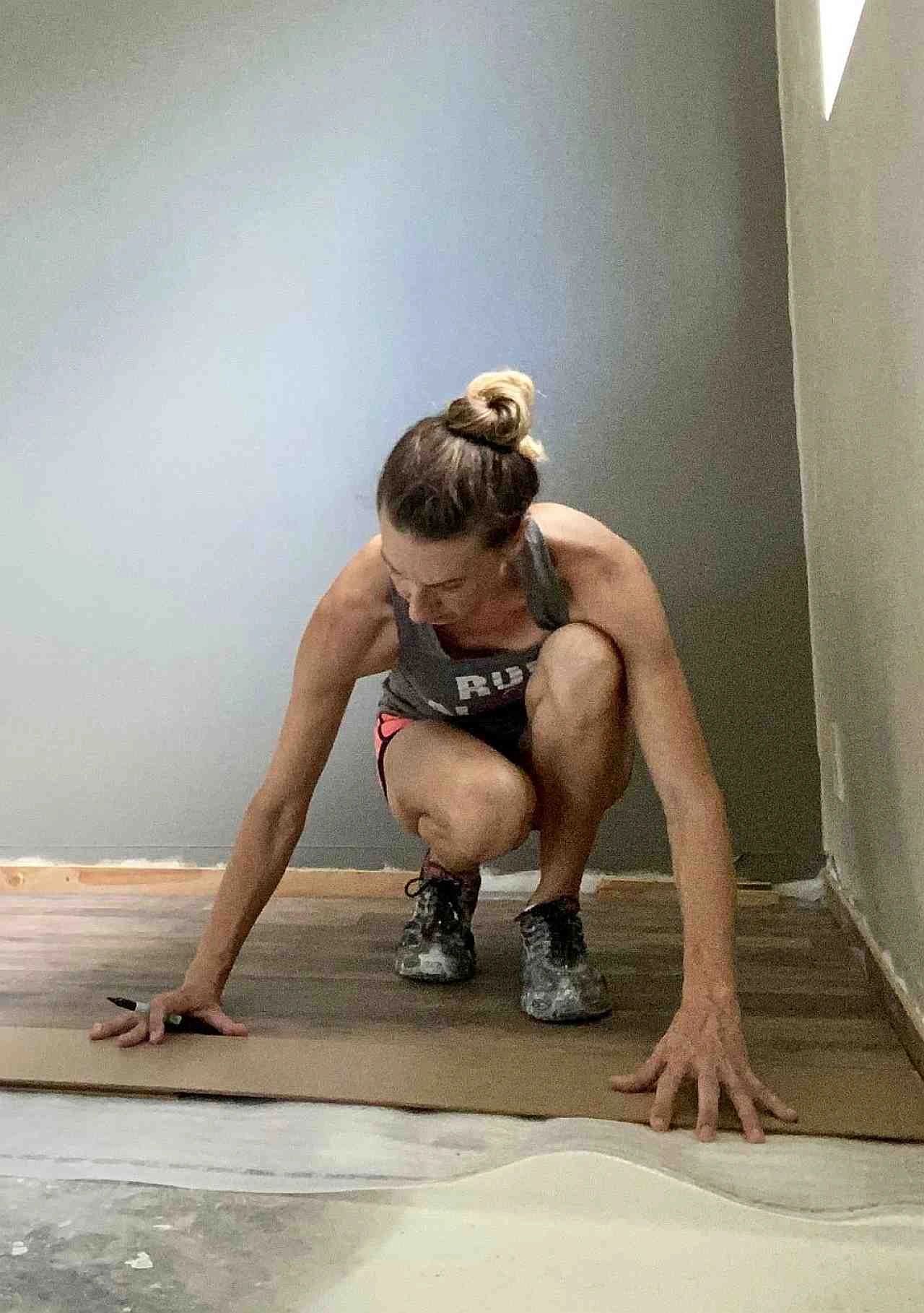

Effective renovation strategies can significantly impact the value and appeal of your flipped property. It’s crucial to have a solid team of contractors and designers to help bring your vision to life. It can be particularly challenging here in Hawai’i to find industry professionals who will show up reliably, provide quality services, and use locally sourced and eco-friendly materials whenever possible.

Here are some key techniques and considerations to maximize your investment:

1. Prioritize High-Impact Renovations:

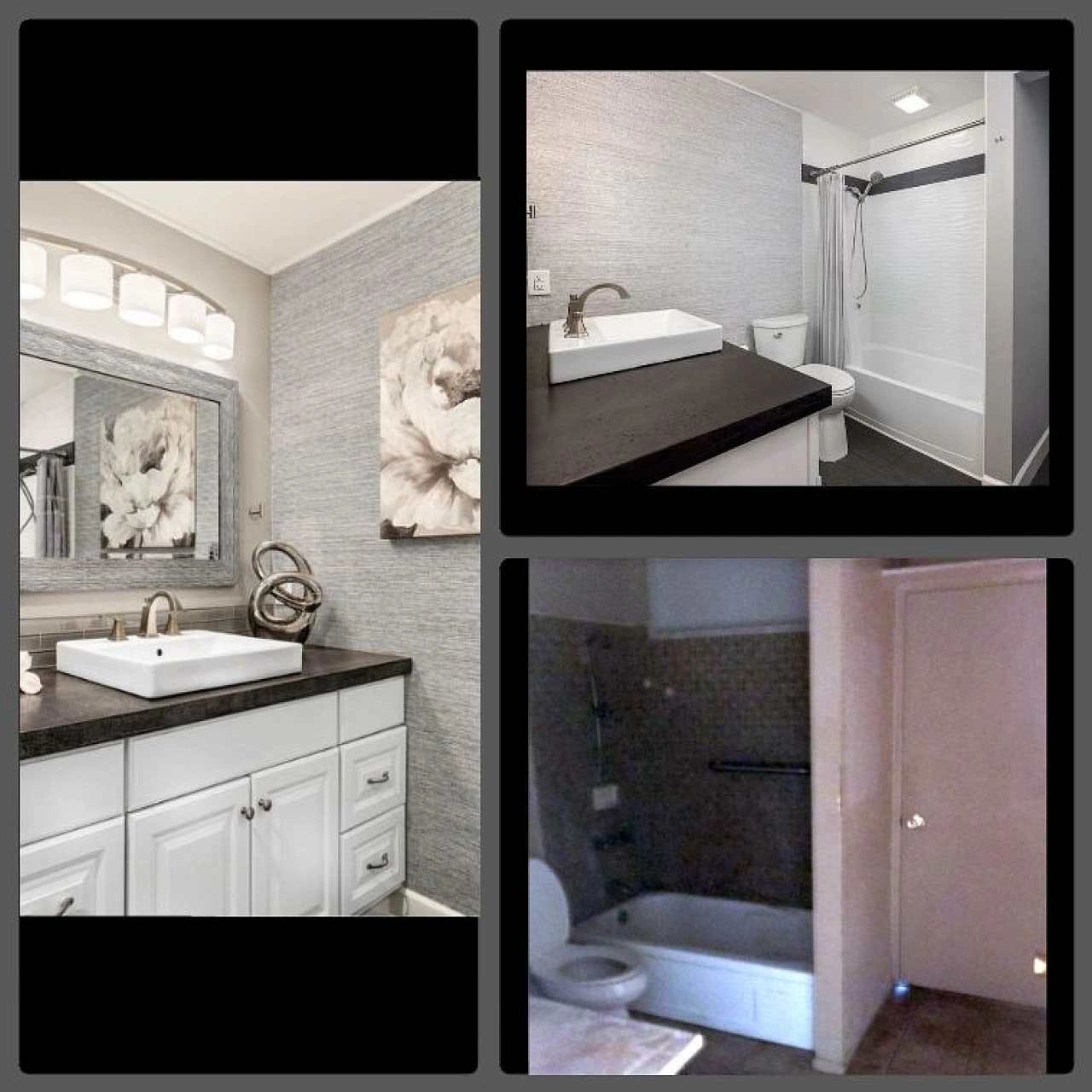

- Kitchen and Bathrooms: These are often considered the most important rooms in a home and can significantly increase its value. Focus on updating outdated fixtures, appliances, and finishes.

- Flooring: New flooring can instantly transform a space. Consider durable options like hardwood (eco-friendly options like bamboo), luxury vinyl plank (LVP), or tile.

- Paint: A fresh coat of paint can make a dramatic difference in a room’s appearance. Choose neutral colors to appeal to a wider range of buyers.

2. Focus on Curb Appeal:

- Landscaping: Create a welcoming exterior with well-maintained landscaping, including lawn care, flower beds, window boxes, and shrubbery.

- Exterior Features: Repair or replace damaged siding, windows, and doors to improve the property’s overall appearance.

- Front Porch or Patio: A well-designed outdoor space can add value and appeal.

3. Energy Efficiency:

- Upgrades: Invest in energy-efficient appliances, lighting, and insulation to reduce utility costs and attract eco-conscious buyers.

- Certifications: Consider obtaining energy efficiency certifications, such as ENERGY STAR, to increase the property’s value.

4. Accessibility Features:

- Universal Design: Incorporate features that are accessible to people with disabilities, such as wider doorways, grab bars, and lever-style handles.

- Aging in Place: Consider designing the property to accommodate aging homeowners, such as walk-in showers and first-floor bedrooms.

5. Quality Materials and Craftsmanship:

- Durable Materials: Choose high-quality materials that will withstand wear and tear.

- Professional Contractors: Hire skilled and experienced contractors to ensure a well-executed renovation.

- Attention to Detail: Pay attention to the small details, such as finishing touches and clean lines, to create a high-quality finished product.

By implementing these renovation strategies, you can enhance the value and desirability of your flipped property, attracting more buyers and potentially commanding a higher selling price.

House Flipping 101.4. Market Timing: Selling Your Flip at the Optimal Moment

Timing the sale of your flipped property is crucial to maximizing your return on investment. Here are some key factors to consider:

1. Market Conditions:

- Supply and Demand: Analyze the local real estate market to determine the current supply of properties and the demand from buyers.

- Economic Indicators: Monitor economic factors such as interest rates, job growth, and consumer confidence, as they can influence buyer behavior.

2. Seasonal Trends:

- Peak Selling Seasons: Identify the peak selling seasons in your area, which may vary depending on local factors.

- Off-Peak Seasons: Consider the potential advantages and disadvantages of selling during off-peak seasons, such as fewer competing properties but potentially lower demand.

3. Property Value Trends:

- Appreciation: If property values are rising, it may be advantageous to sell sooner to capitalize on the appreciation.

- Market Corrections: Be aware of potential market corrections or downturns that could affect property values.

4. Buyer Demand:

- Target Audience: Identify your ideal buyer profile and tailor your marketing efforts accordingly.

- Buyer Preferences: Understand the preferences of buyers in your area, such as desired features, amenities, and price ranges.

5. Competition:

- Competing Properties: Analyze the number and types of competing properties in your area.

- Pricing Strategy: Determine your property’s competitive pricing based on comparable sales and market conditions.

By carefully considering these factors and adapting your selling strategy accordingly, you can increase your chances of selling your flipped property at the optimal time and for the best possible price.

House Flipping 101.5. Avoiding Common Pitfalls: Lessons from Experienced Flippers

Even the most experienced house flippers have made mistakes along the way (we certainly have made our share of mistakes!). Flipping houses is not for the faint of heart, to put it mildly. It involves significant risks and requires a great deal of courage. Trust me when I tell you it’s not as easy as they make it look on HGTV! For a good read, check out this article in The Atlantic called “The HGTV-ification of America.”

By understanding common pitfalls, you can avoid costly errors and increase your chances of success.

1. Underestimating Costs:

- Hidden Costs: Be prepared for unexpected expenses, such as structural issues, environmental hazards, or permit fees.

- Contingency Fund: Allocate a portion of your budget for unforeseen costs to prevent financial setbacks.

2. Overestimating Value:

- Market Research: Conduct thorough market research to determine realistic property values and avoid overestimating the selling price.

- Renovation ROI: Focus on renovations that provide a significant return on investment and avoid overspending on features that may not add value. For more information about trendy renovations that don’t provide a good return on your capital investment, check out our Home Renovation Blog post.

3. Lack of Due Diligence:

- Property Inspection: Conduct a thorough inspection to identify potential problems before purchasing the property, if possible. Many foreclosures and other rehab properties may have “as-is, no inspection” conditions of sale. Have a survey done by a licensed surveyor to determine the exact property lines.

Personal story: We lost an all-cash deal on our first home flip because we didn’t know the back deck encroached the HOA common area by over 15 feet! We had to deal with lawyers, an irrational HOA, and inevitably had to tear down the deck and re-size it to fit within the property lines. It pays to get surveys and other inspections so that you know what you are dealing with.

- Zoning and Permits: Verify zoning restrictions and obtain necessary permits to avoid legal issues and delays. Check out the Hawai’i County Planning Department website for more information on these important zoning and permitting issues for our island.

4. Time Management Challenges:

- Project Planning: Create a detailed project timeline and allocate sufficient time for renovations and the selling process.

- Unexpected Delays: Be prepared for unexpected delays due to supply chain issues, weather, or unforeseen challenges.

- Overextending Yourself: Stress and Time Commitment: Flipping houses is time-consuming and can be emotionally taxing, particularly if you encounter unexpected challenges. (Personal note: On many occasions, I wasn’t sure that Kamu and I were going to stay together after our first flip! It’s a learning curve, to be sure.)

- Financial Limits: Avoid taking on more debt than you can comfortably handle. The upfront costs of purchasing a property and funding renovations can be substantial. If your project doesn’t sell as quickly as anticipated, you may carry the financial burden for an extended period. Interest and loan costs add up quickly, especially if you use a “hard-money” loan to fund the project.

- Multiple Flips: Start with one house flip to gain experience before taking on multiple projects.

5. Emotional Attachment:

- Objective Decisions: Make decisions based on financial considerations, not emotional attachments to the property.

- Professional Advice: Seek advice from experienced real estate professionals to maintain an objective perspective. Many real estate agents are unfamiliar with the county foreclosure auction process, so ask prospective agents questions to see their experience.

6. Neglecting Marketing:

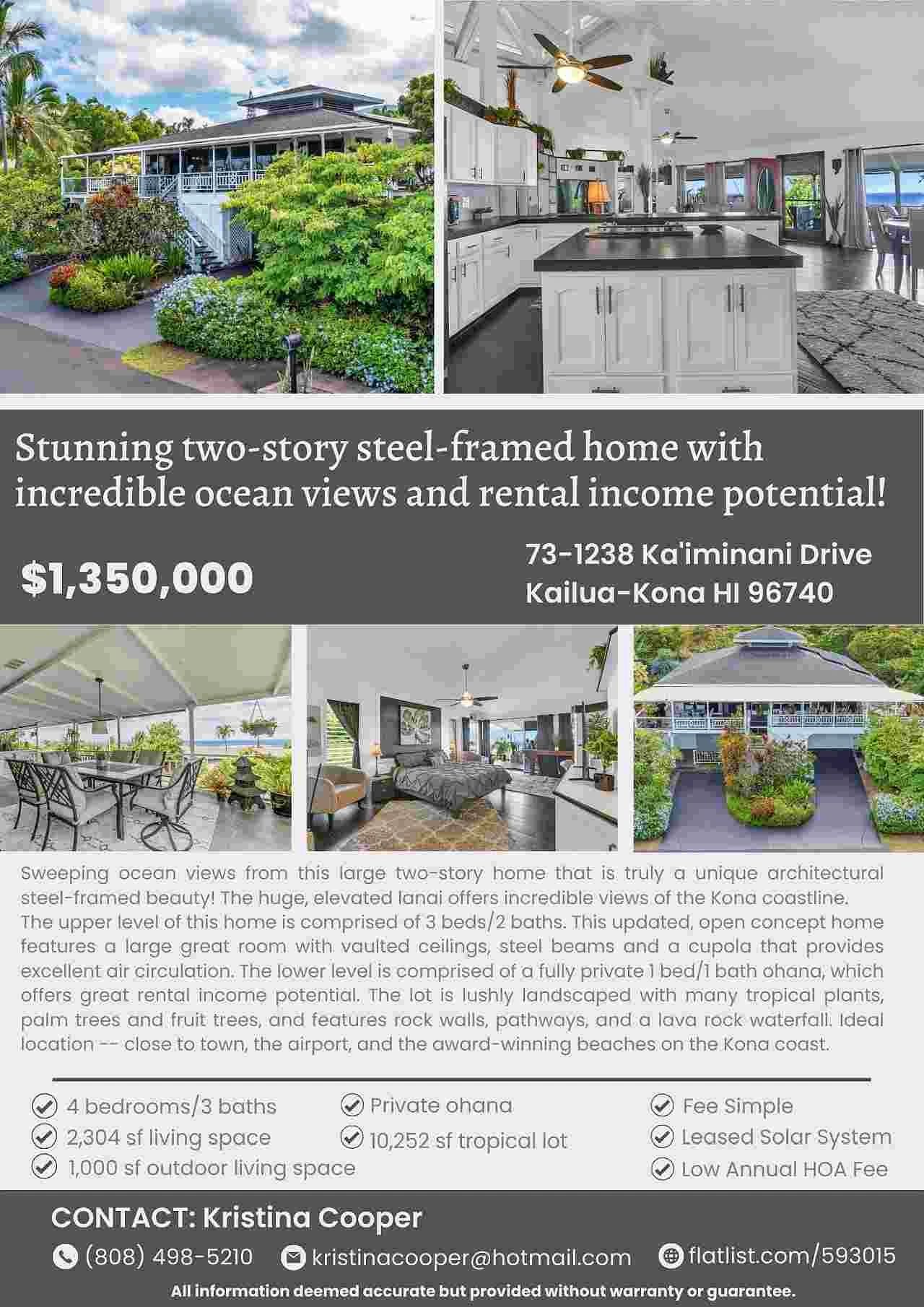

- Effective Marketing: Utilize a variety of marketing channels to reach potential buyers, including online listings, social media, and open houses. There are many flat-list MLS listing agencies these days, and if you have enough real estate experience to sell a property yourself, it’s essential to market your flip property to sell quickly.

Pro Tip: Did you know that Zillow and other MLS sites will boost your listing to the top every time you hold an open house? It’s a great way to continually generate interest in your property.

- Professional Photography: High-quality photos can make a significant difference in attracting buyers. I’ve seen far too many MLS listings by for-sale-by-owners or agents who think they can take pictures of a property with their iPhone. Don’t do it. Get a professional real estate photographer with drone experience – you won’t regret the $350-500 expense!

By understanding and avoiding these common pitfalls, you can increase your chances of successful house flipping and achieve your financial goals.

House Flipping 101: Conclusion

Flipping houses is a dynamic and rewarding venture that offers the potential for significant financial gains and positive community impact. It requires a combination of financial acumen, renovation expertise, and strategic thinking to navigate the challenges and maximize the rewards.

While the risks and downsides are real, the potential benefits are equally substantial. Successful house flippers are those who carefully balance the risks with the rewards, understand the importance of market timing, and are committed to creating high-quality, sustainable properties that enhance their communities.

There is also a sense of accomplishment that comes with taking a dilapidated property and turning it into a beautiful, functional home. Kamu and I focus on one property at a time to ensure our renovated homes are done correctly – taking the time to make sure that every decision we make is with the new homeowner in mind for the long term.

If you’re considering house flipping, be sure to do your research, seek advice from experienced professionals, and be prepared for the journey ahead. With the right approach, house flipping can be a fulfilling and profitable endeavor.

As always, mahalo for joining us at Eco-Luxe Living: Hawai’i, and be sure to check out our latest Home Renovation Blogs for more expert advice and inspiration. If you have a home renovation project or blog idea, we’d love to hear from you!